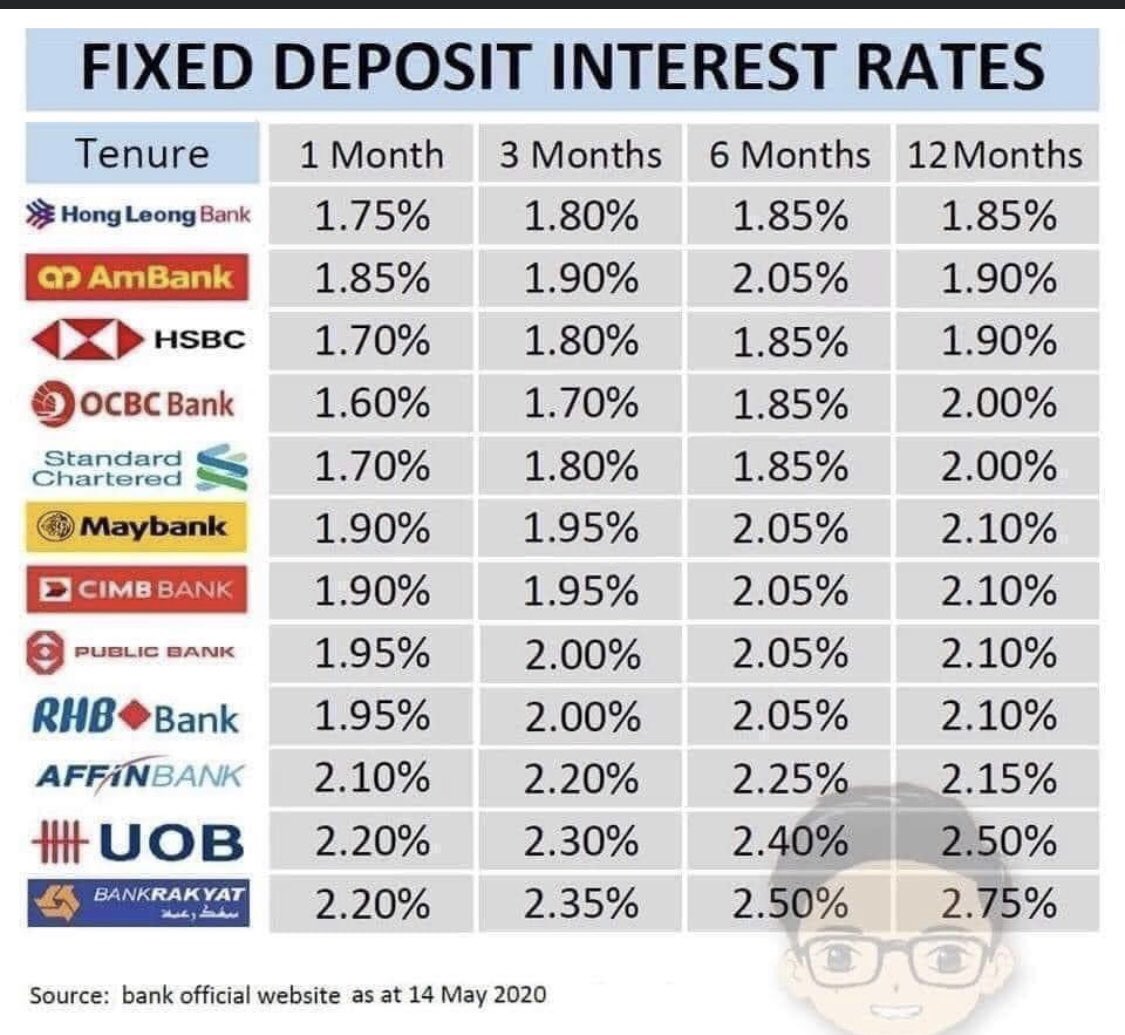

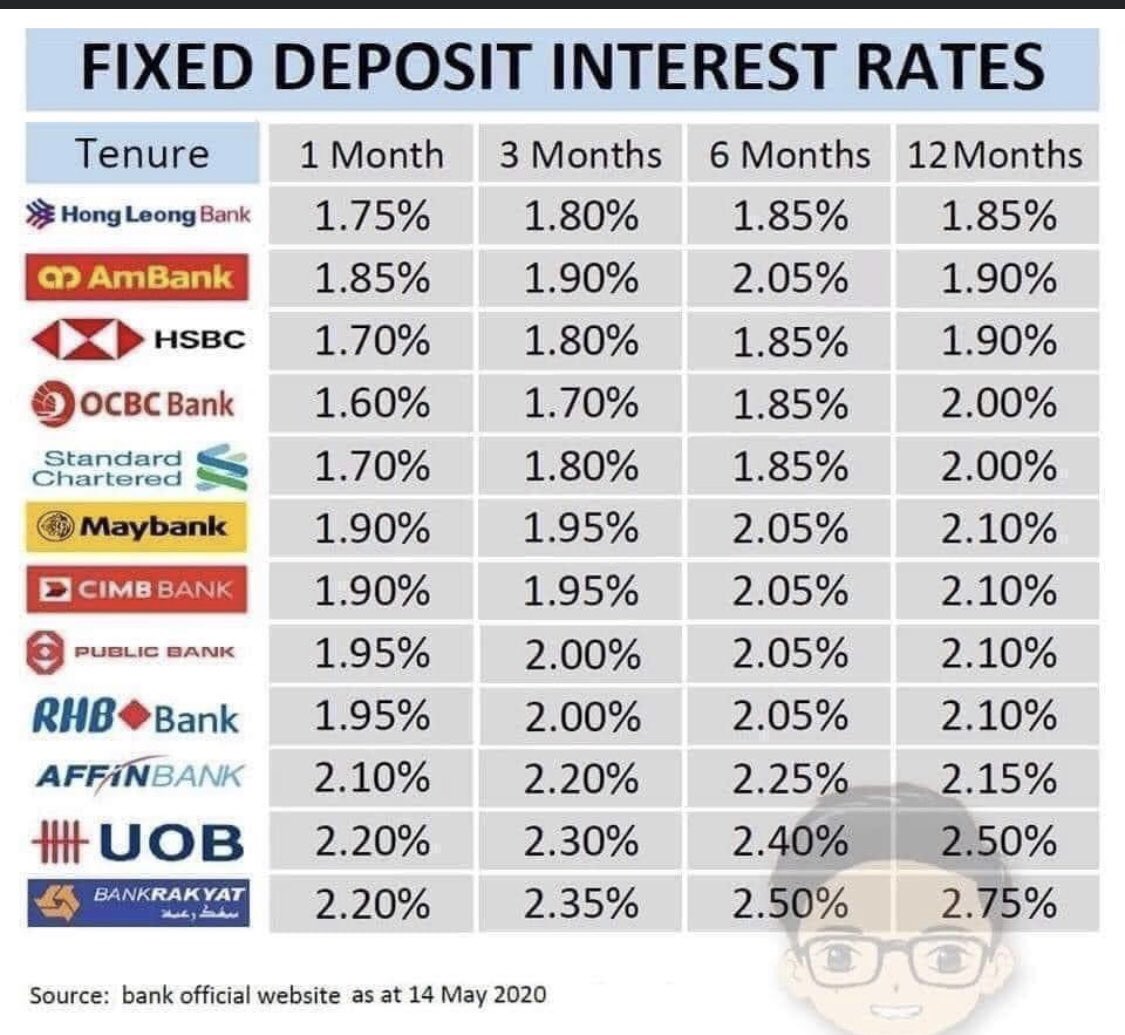

Ambank Fixed Deposit Rate

Receive 1.65% / 1.55% p.a. Interest for 7 / 12 months Amonline Web eFixed Deposit / Term Deposit Applicable to minimum placement of RM10,000 and above Other tenures from 1 to 60 months.

Latest

BLR / BFR

AmBank

5.45%

| Effective from 14 July 2020 |

|

Latest

Base Rate

AmBank

2.60%

| Effective from 14 July 2020 |

|

| ►AmBank BR / BLR / BFR Historical Data |

AMMB Holdings Berhad ('AmBank Group') provides a wide range of financial products and services through its major subsidiaries including AmBank (M) Bhd, AmInvestment Bank Bhd, AmInvestment Group Bhd, AmLife Insurance Bhd, AmG Insurance Bhd and AmIslamic Bank Bhd.

Incorporated in 1975, today its business divisions covers activities across retail banking, business banking, transaction banking, corporate and institutional banking, investment banking including funds management and stock broking, markets, general insurance, life assurance and Takaful. These business divisions offer both Conventional and Islamic financial services.

The AmBank Group is one of Malaysia's premier financial services group with leadership positions in the retail banking, commercial banking, investment banking and insurance sectors. With an established history and a track record of customer focus and innovation, the AmBank Group continues to serve its customers with a wide range of innovative products and services.

The Group firmly believe that it can extend its leadership positions by deploying the knowledge and skills of our staff, harnessing the power of cutting-edge technology and capitalising on its strong brand equity.

Got any question on BLR or Base Rate? Contact AmBank Call Center at 1300 80 8888 (603 2178 8888) or visit any of your nearest AmBank branch.

Effective Lending Rate

The indicative Effective Lending Rate for AmBank is 3.25% with effective from 14 July 2020.

Note:

Indicative Effective Lending Rate refers to the indicative annual effective lending rate for a standard 30-year housing loan / home financing product with financing amount of RM350k and has no lock-in period. Find out more information on Effective Lending Rate. |

- The AmBank Targeted Repayment Assistance Programme is aimed at assisting our customers from the B40, M40 and micro enterprises segment who have suffered job loss or income reduction arising from COVID-19, and require financial assistance for their monthly financing payments.

- The rate indicated is applicable to the 'conventional fixed deposit rates' and the 'AmOnline Rate' product with a tenure of 1 month. The rate of 3.15% is 0% higher than the average 3.15%. Also it is 0.25% lower than the highest rate.

Ambank Fixed Deposit Rates

| Financial Products: |

| • Savings Account | • Home Loan / Mortgage Loan | • Islamic Banking |

| •Current Account | • Personal Loan | • Share Margin Financing |

| • Fixed Deposit Account | • Hire Purchase (Car Loan) | • Premier Banking |

| • Foreign Currency Account | • Term Loan | • Bancassurance |

| • Remittance Services | • Study Loan | • ASB Financing |

| • Overdraft Facility (OD) | • Charge Card | • Unit Trust |

| • Trade Finance | • Credit Master Card |

| • Contract Financing | • Credit Visa Card |

| • SME Financing | • Debit Card |

Ambank Fixed Deposit Rate

| Related Information: |

| •BNM keeps OPR at 1.75%- 4 March 2021 |

| •Latest Base Rate |

| • Guide to consumer on Base Rate |

| • FAQs on Base Rate (BR) |

| •Base Rate vs BLR |

| • BLR Comparative Table |